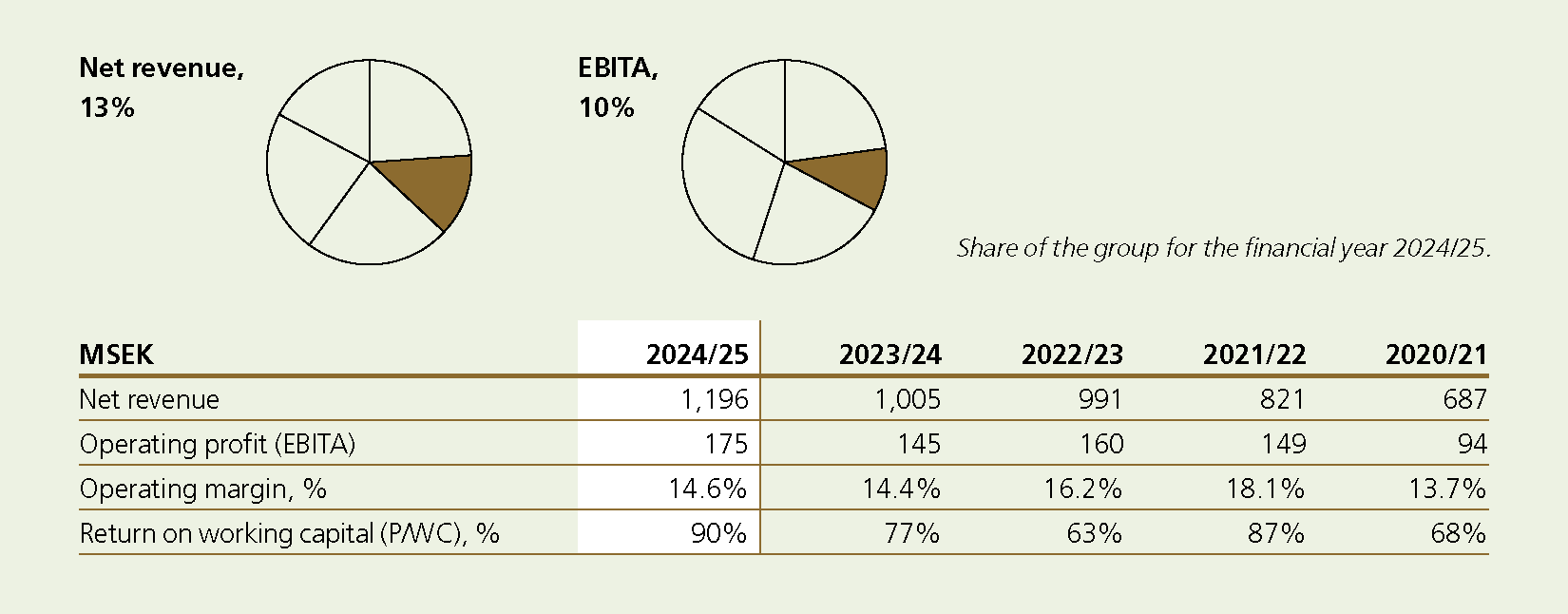

Control

Society’s need for continually improved resource utilisation and more efficient processes is the key driving force for companies in the Control division. Here, companies in measurement and control technology are brought together, as well as businesses that in various ways move or protect sensitive assets in critical processes.

About the division

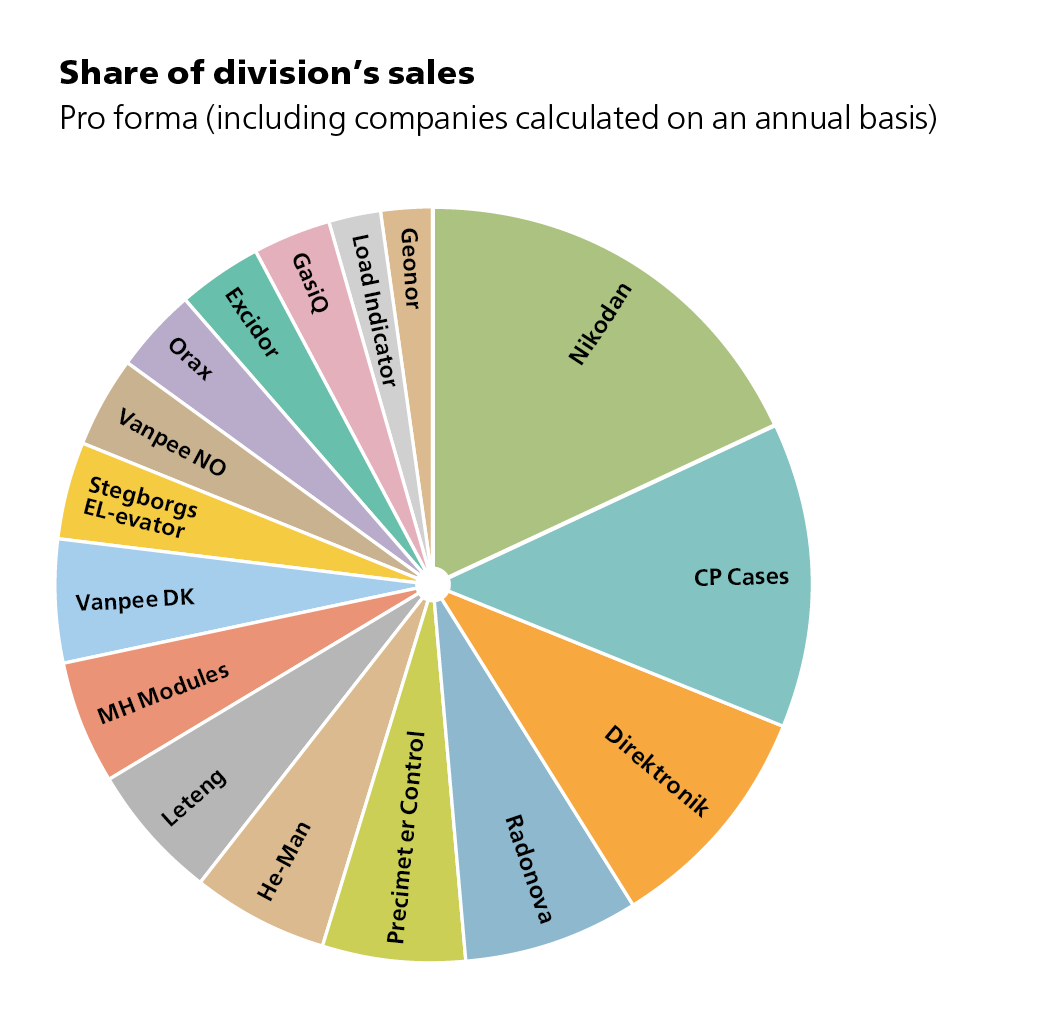

Today, the division consists of 16 specialised companies with a great variation in focus – everything from control systems for lifts and level sensors for molten metals, to protective cases for the transport of advanced communications equipment and conveyors for foodstuff with high hygiene requirements. What they all have in common is that, through their products and solutions, they optimise processes by contributing to increased precision, reliability and resource efficiency.

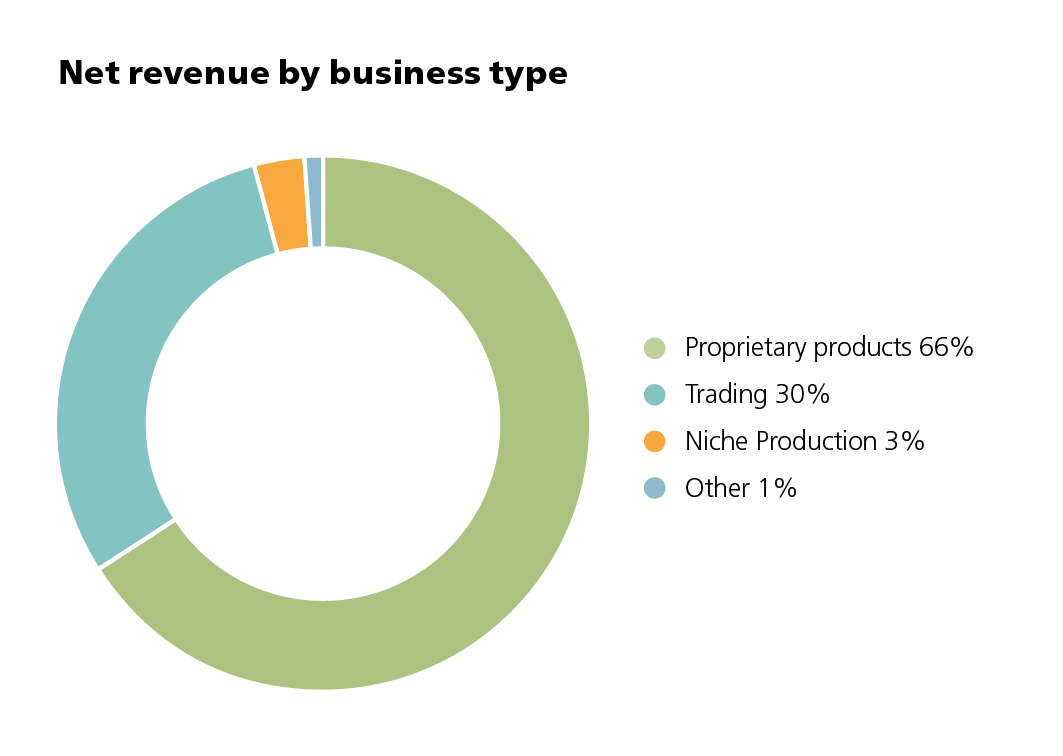

Many of the product companies are leaders in their respective niche, often world leaders with significant global exports. The division also includes several niche value-adding distributors in areas such as networks, signal processing, audio/video, lighting and monitoring.

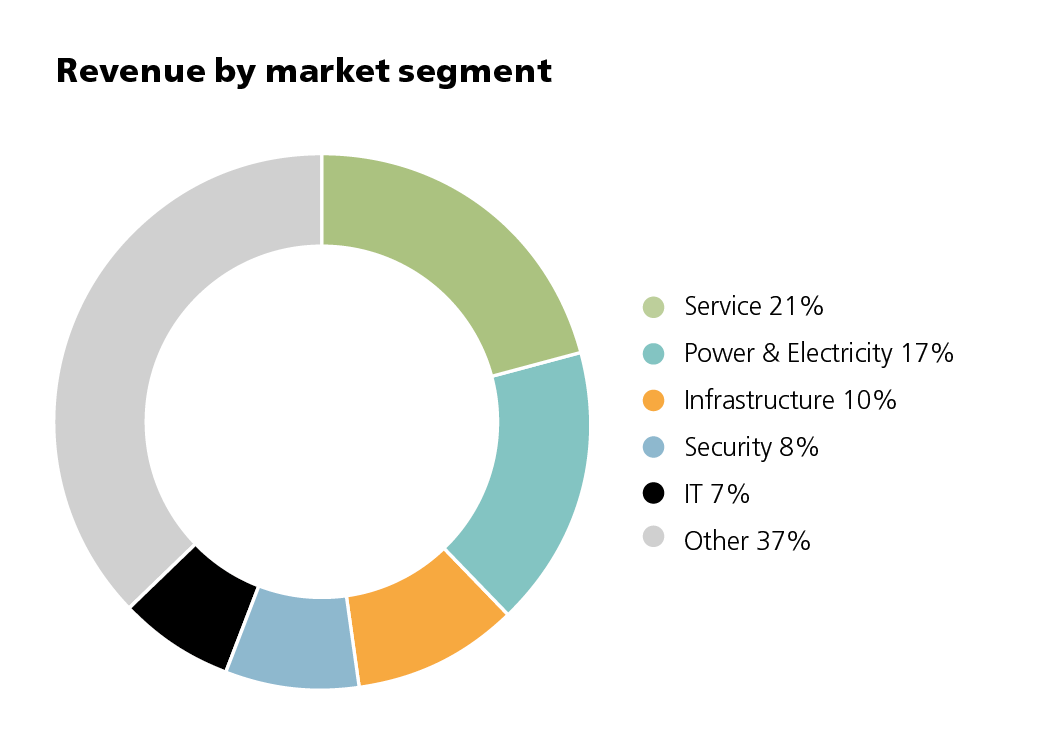

Customers are found in a range of sectors with a need for optimised processes – including the defence industry, the property and construction sector, the communications industry, medical technology, the food processing industry as well as manufacturers of construction equipment. Common to these industries are the requirements for high precision, reliability and efficient use of resources.

The division’s long-term goal is to achieve organic growth of more than 5% per year over a business cycle and to carry out about three acquisitions annually. The acquisitions aim to complement existing businesses or create new, independent profit centres in expansive niches – preferably with the potential to become market leaders, both nationally and internationally.

About the businesses

The companies in the division all have unique positions within their specific markets, Some of the businesses are described here below.

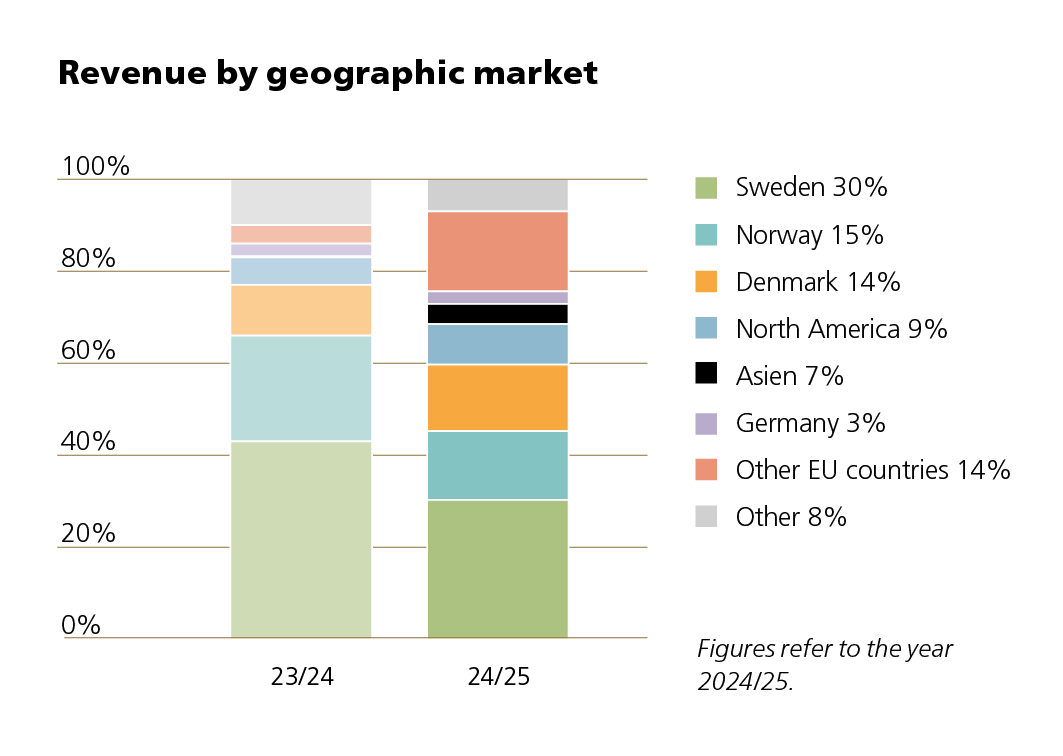

Radonova is a world leader in radon measurement and the division’s largest unit in terms of earnings. From the base in Uppsala and Sweden, exports are growing to the Nordic countries, the rest of Europe and in North America. Radon measurement occurs in residential properties but also to an increasing extent in workplaces, at schools and at day nurseries and in mines. The market is growing generally due to stricter requirements from public authorities and as a consequence of digitalisation. Precimeter develops laser sensors for advanced control of molten metal level measurement in smelters around the world. GasiQ designs and manufactures cost-saving regulators and other gas equipment. Besides their innovative corporate culture, all three companies develop world-leading technology for measurement and control with sales throughout the whole world. The three companies generate an annual revenue of approximately MSEK 200.

Excidor develops control systems for maintenance vehicles such as snow ploughs, tiltrotators and brushes, an area where Excidor and other Scandinavian companies are world leaders. Load Indicator is also connected to the automotive industry with development and own production of components for force and torque measurement, for example for weighing loads and for controlling industrial tools. The two companies generate an annual revenue of approximately MSEK 80.

Direktronik in Sweden imports and refines components for efficient solutions in communication networks, while Leteng in Norway has a similar business focused on signal processing for audio/video. The two Vanpee companies in Norway and Denmark are also so-called value-adding distributors, with a focus on environmental and energy saving lighting components and lighting controls. They also offer high quality and smart products in electromechanics, cabling materials, connectors and passive components for several industries. Together the companies generate annual revenue of approximately MSEK 360.

The Norwegian company Geonor manufactures and sells geotechnical, hydrologicla, metereological and environmental equipment and solutions to a broad customer base in Norway and internationally. The company has a turnover of approximately MSEK 30 with good profitability. In July 2022, Stegborgs El-evator was acquired. The company has a strong position in the renovation and reconstruction market for elevators and with its proprietary control and modular system, there are good prerequisites for continued expansion in Sweden. The company has a turnover of just over MSEK 60 with good profitability. He-Man is a leading developer and manufacturer of supplementary control and dual-command systems for vehicles. The product range covers nearly 400 current vehicle models with manual, automatic, hybrid, and electric drivetrains. Each system is specifically designed to fit particular car makes and models.

The company is headquartered in Southampton and holds a leading position in the UK market, with a growing presence in other European countries as well. Orax is a leading Swedish product company headquartered in Vårgårda, specializing in the development, manufacturing, and sale of products for the handling, transport, and storage of coffins, grave security, as well as the maintenance and decoration of cemeteries