Niche Products

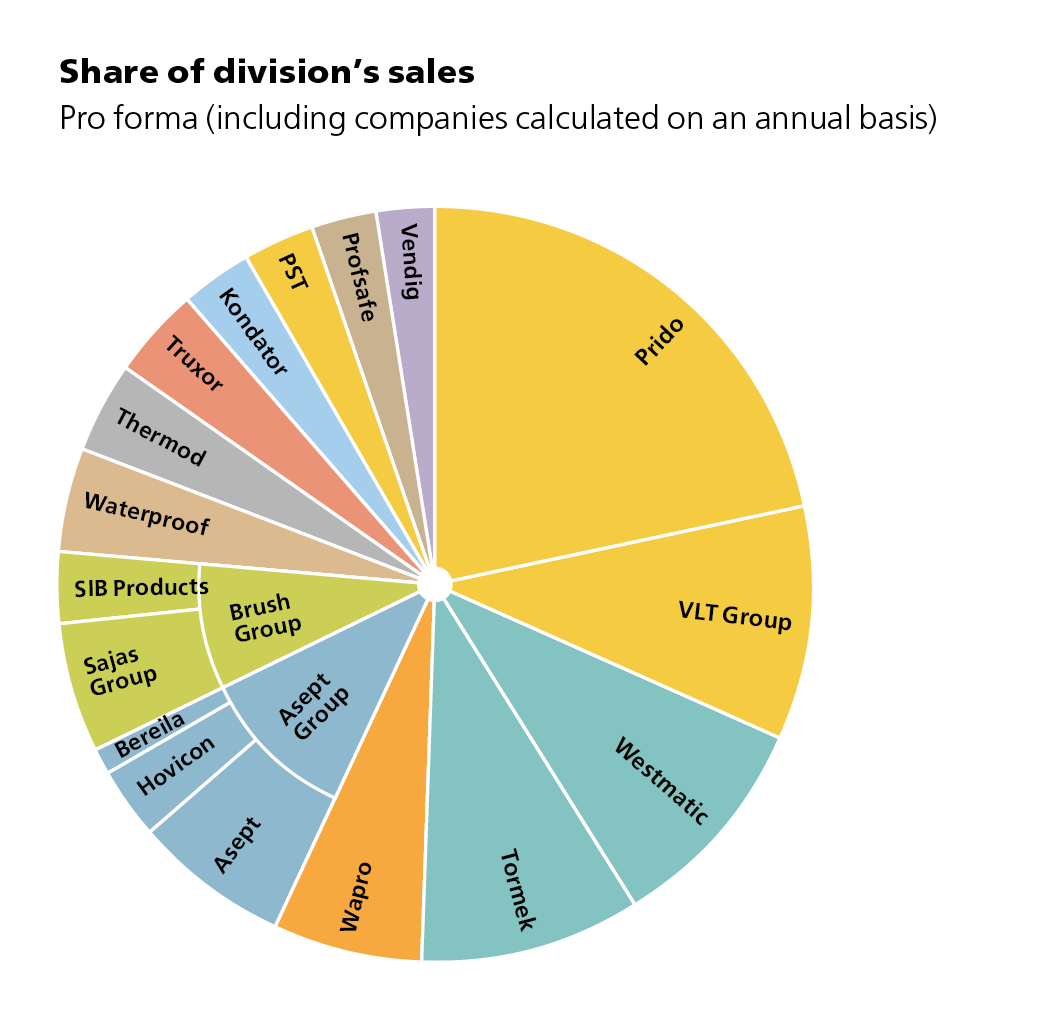

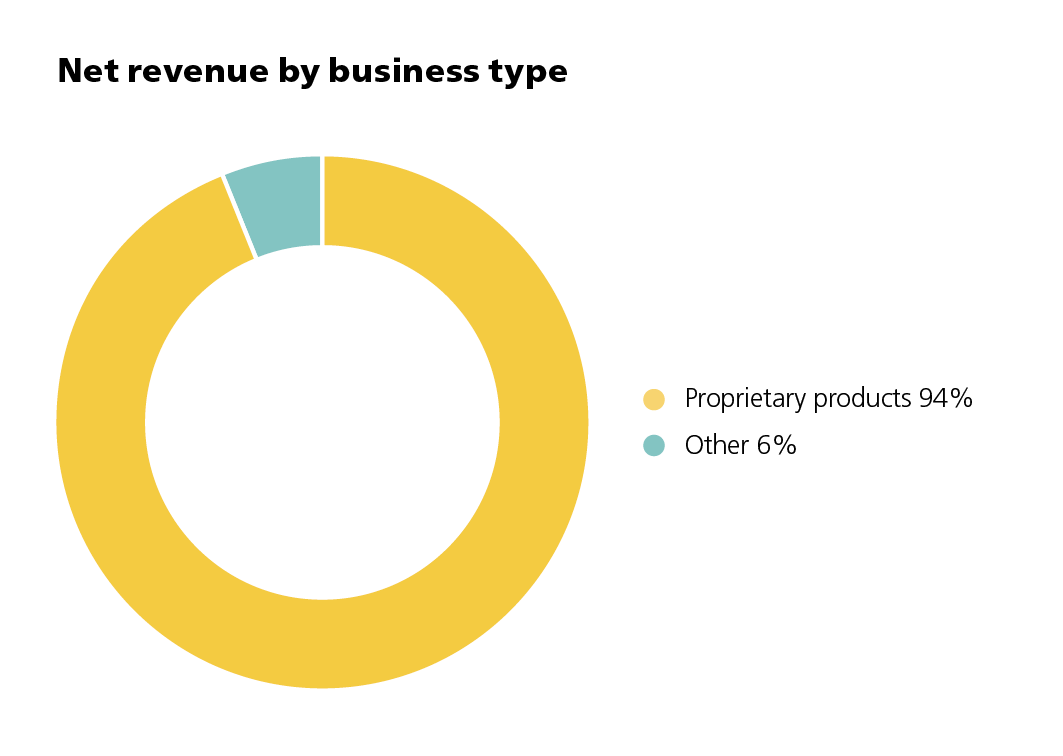

Lagercrantz has built the Niche Products division around a number of product companies in various niches. Today, the division consists of 17 profit centres, where each one is a leader in its respective niche with stable and high profitability. The focus is on acquiring and refining niche companies with proprietary products.

About the division

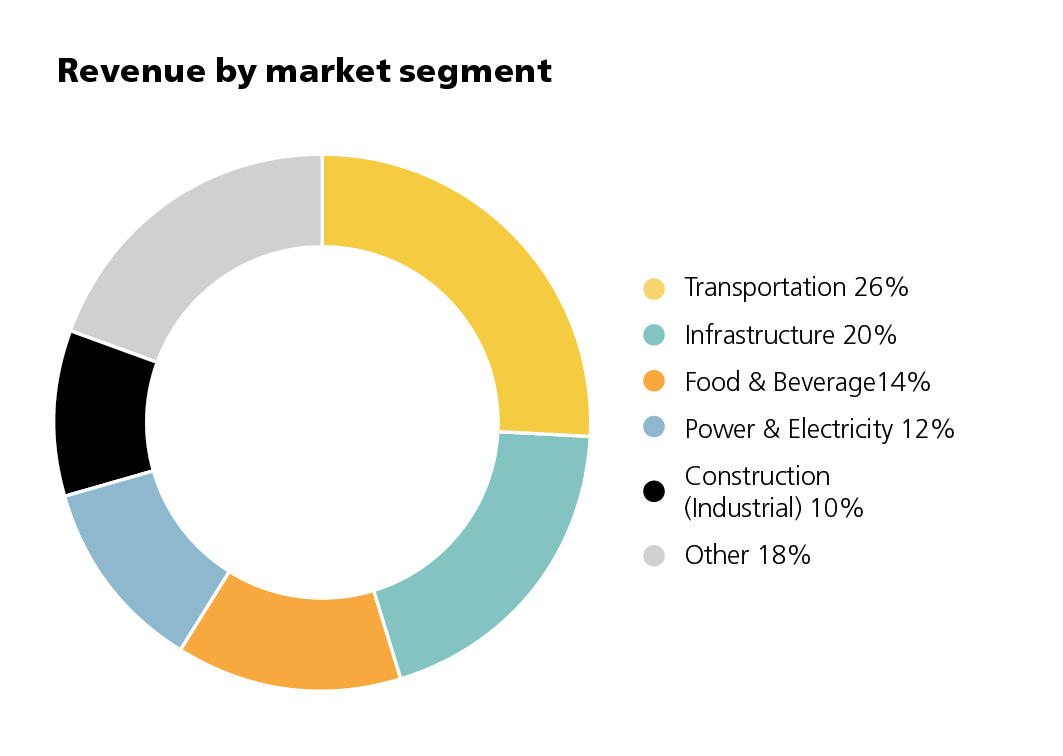

The division’s companies sell proprietary products and solutions in selected technology niches, for example washing systems for heavy vehicles, dispenser systems for foodstuffs, sharpening systems for knives and other edge tools, special doors for refrigeration rooms and hospitals as well as valves for land-based fish farms.

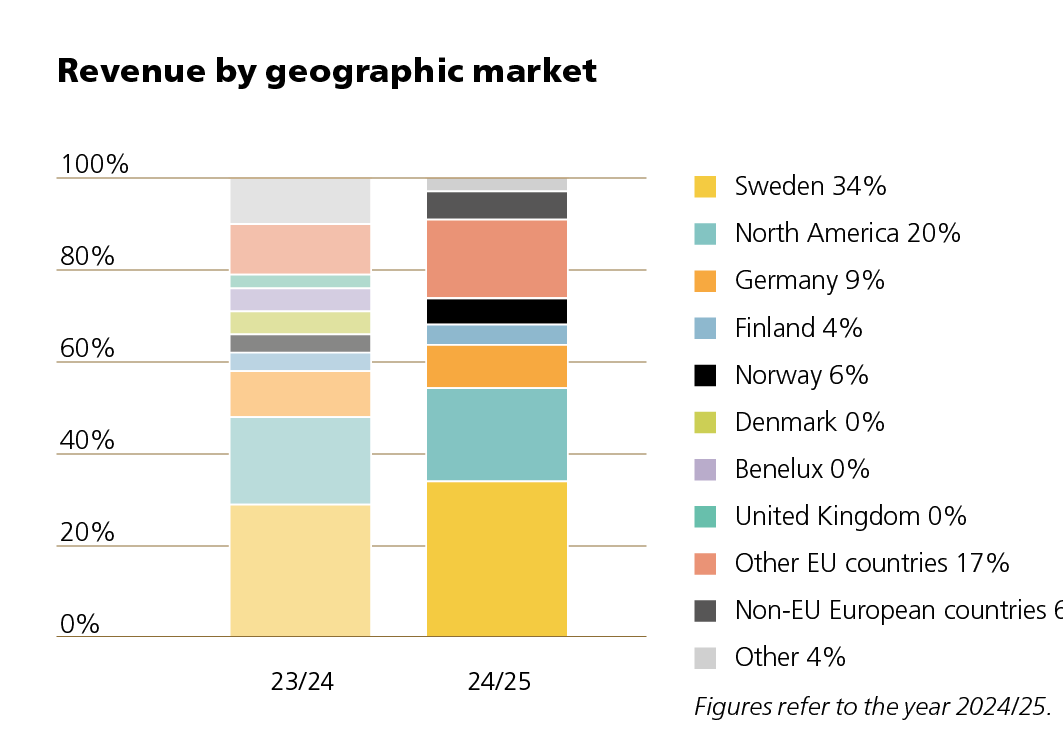

Most of the division’s companies are based in the Nordic countries but several also have subsidiaries in countries such as the USA, Netherlands and Poland.

In many of the companies, the technical solutions required for a more sustainable society have become an integrated part of the business. In various ways, they deliver innovative products and solutions that directly or indirectly reduce society’s consumption of water, plastic and herbicides or protect against the effects of climate change. Several companies are now developing the next generation of products from recycled or biodegradable materials by focusing on innovation and development of technical solutions.

Aside from new acquisitions, the division is also growing through add-on acquisitions. In this way, the position is being strengthened in existing niches and sub-groups or clusters that have been established, for example, within dispensers, special brushes, flow control and special conveyors.

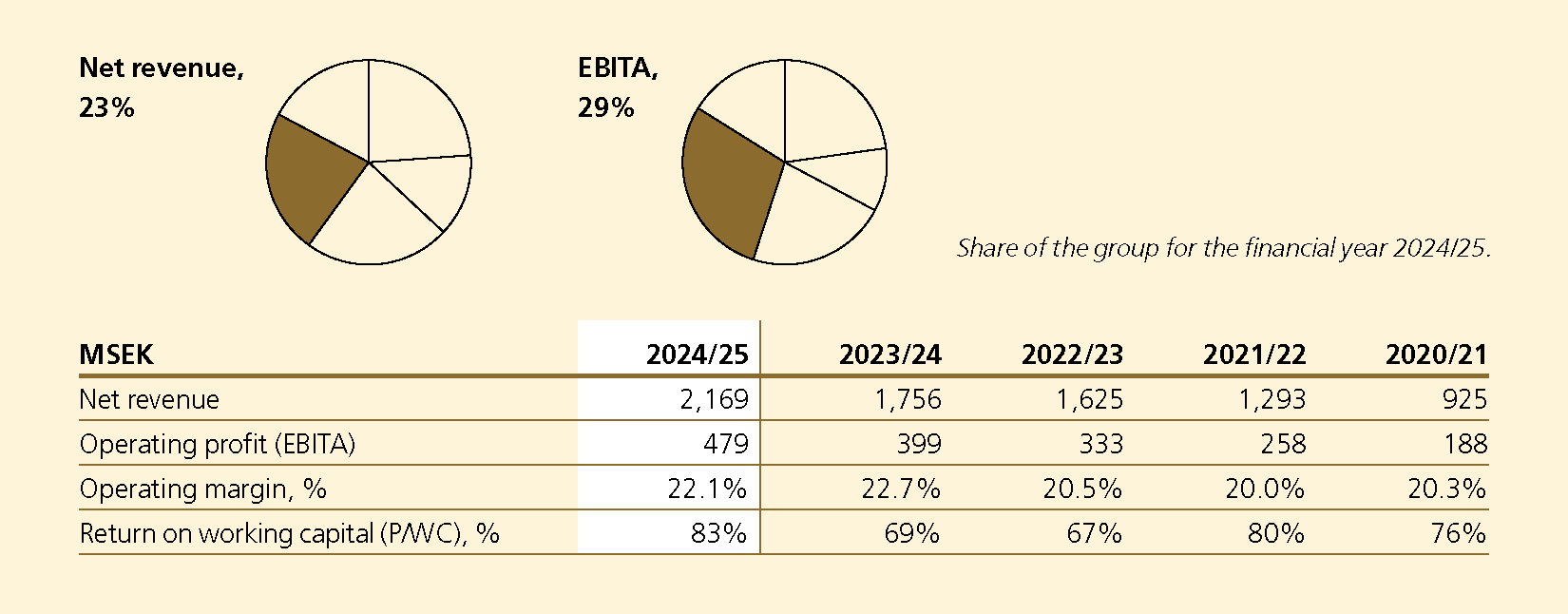

Going forward, the goal is to continue growing in line with the Group’s ambitions and to double the division’s EBITA within five years. The goal is to carry out 2–4 acquisitions per year, including smaller add-on acquisitions.

About the businesses

The companies in the division all have unique positions within their specific markets, Some of the businesses are described here below.

Asept Group started with an acquisition in 2013 and since then the business has been developed through several supplementary acquisitions, of which Hovicon, acquired in 2020, is the largest. Asept is a global leader within dispensing of liquid foodstuffs and recently also single use pumps for alcogel. Asept has operations in Sweden, the Netherlands and the USA, which is their largest market. The customers are the large well-known consumer products companies, which by using Asept’s solutions can reduce the product quantity and increase the recycling rate of packaging materials. Asept Group generates an annual revenue of approximately MSEK 200.

Tormek was acquired in 2018 and is a leader within sharpening systems for edge tools such as knives, chisels and tools for woodcarving. Demand is driven by trends towards increased DIY and reuse of tools. Development and manufacturing takes place in Sweden and sales through resellers in 40 countries, with the USA, Germany and Sweden as the largest markets. The company generates an annual revenue of approximately MSEK 200. Truxor Wetland Equipment are experts in amphibian machines for lake clearance, wetland and water conservation, with solutions for reed cutting, oil decontamination, excavation and dredging. The need for mechanical water conservation is increasing as the use of chemicals is regulated in more and more parts of the world. The annual revenue is approximately MSEK 125.

Forming Function develops functional and ergonomic accessories for office furniture such as power outlets, lighting and storage solutions. The products are mainly sold via office furniture manufacturers and interior decoration firms in Sweden and the Nordic countries, but also in Germany and Benelux. The company was acquired in 2016 and has an annual revenue of just over MSEK 100. In the brushes product area the division has acquired the Swedish company SIB Products, which has a world-leading position in brushes for snow clearance of airport runways. Within the same niche, in 2020, Sajas Group with operations in Finland, Estonia and Germany and a leading position in road brushes in the Nordic countries and Germany, was acquired Together the two companies generate an annual revenue of approximately MSEK 150.

Wapro, with operations in Sweden and Denmark, has achieved international success with its patented check valves as more and more coastal areas need to be protected from unstable weather and rising sea levels. In December 2021, the division acquired Westmatic, a leading supplier of environmentally friendly automated washing systems for heavy-duty vehicles. With operations in Arvika and Buffalo, the company has a strong market position in Sweden, Norway and North-eastern North America. Finally, Waterproof Diving International was acquired in September 2022, a leading supplier of custom diving suits for professional, civilian and military purposes. Together, these companies have a turnover of approximately MSEK 400.

Van Leeuwen Test Group (VLT) provides equipment primarily for testing heavy vehicles and is particularly known for its robust brake testers and software for vehicle testing facilities. The company is headquartered in Etten-Leur, the Netherlands, and has annual revenues of approximately 20 million euros with solid profitability.

The division's latest acquisitions are Sit Righ, which provides products for forestry and construction machinery, including a seat leveling system and grapples, and Enskede Hydraul, a distributor of spare parts and hydraulic components with a strong focus on forestry and construction equipment.